nh food sales tax

Its a change that was proposed by Gov. NH Food Protection Food Safety and Defense Specialist - Royann Bossidy.

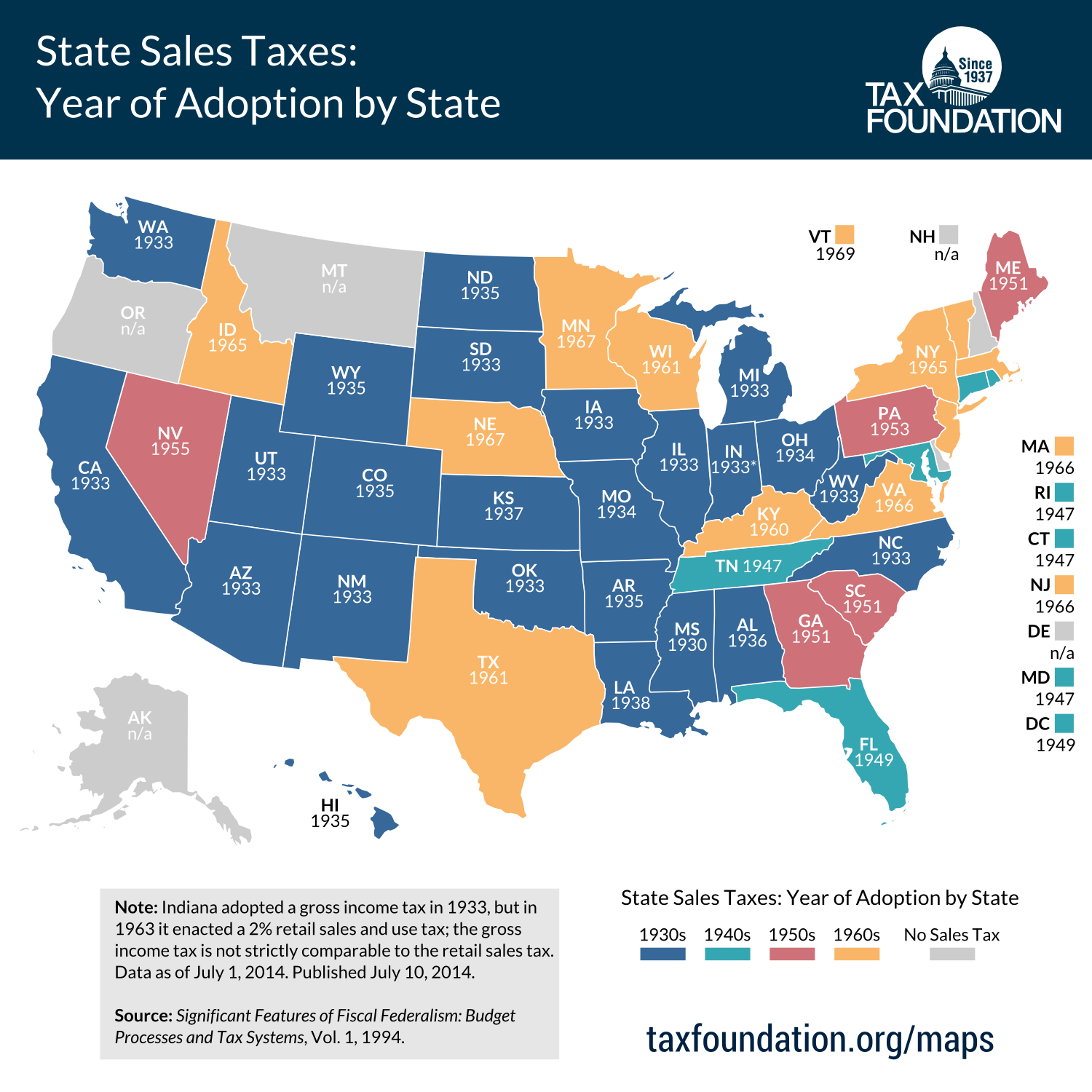

When Did Your State Adopt Its Sales Tax Tax Foundation

Find our comprehensive sales tax guide for the state of New Hampshire here.

. The New Hampshire Sales Tax Handbook provides everything you need to understand the New Hampshire Sales Tax as a consumer or business owner including sales tax rates sales tax. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more. 107 - 340 per gallon or 021 - 067 per 750ml bottle.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. A 7 tax on phone services.

Wayfair decision earlier this summer has stripped New Hampshire retailers. New Hampshire Guidance on Food Taxability Released. New Hampshires sales tax rates for commonly exempted categories are.

A 9 tax is also assessed on motor vehicle rentals. Certain purchases including alcohol. Technical Information Release TIR 2007-005 New Hampshire Department of Revenue Administration August 7.

That includes some prepared ready-to-eat foods at grocery stores like sandwiches and party. Additional details on opening forms can be found here. NH Food Protection Frequently Asked Questions.

2022 New Hampshire Sales Tax Table. For additional assistance please call the Department of Revenue Administration at 603. Prepared Food is subject to special sales tax rates under New Hampshire law.

New Hampshires meals and rooms tax is a 85 tax on room rentals and prepared meals. Sales Tax Compliance Platform. Exact tax amount may vary for different items.

Governor Laura Kelly signed a bill Wednesday which will eliminate the states more. The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is. Looking for information on sales tax in New Hampshire.

2021 New Hampshire state sales tax. If you have a substantive question. Our free online New Hampshire sales tax calculator calculates exact sales tax by state county city or ZIP code.

Federal excise tax rates on beer wine and liquor are as follows. A 9 tax is assessed upon patrons of hotels and restaurants on rooms and meals costing 36 or more. The state meals and rooms tax is dropping from 9 to 85.

Start filing your tax return now. Supreme Courts South Dakota vWayfair decision earlier this summer has stripped New Hampshire retailers of a key advantage in place for decades. NH Has No Sales Tax The US.

1800 per 31-gallon barrel or 005 per 12-oz can. Kansas is getting rid of its state food sales tax on groceries. The latest sales tax rates for cities starting with A in New Hampshire NH state.

A 9 tax is also assessed on motor. Todd Pittenger May 12 2022. New Hampshires meals and rooms tax will decrease 05 percent starting Friday a result of a change in the 2021-2023 budget that brings the rate down to 85 percent.

Rates include state county and city taxes. 2020 rates included for use while preparing your. What is the food tax in New Hampshire.

The New Hampshire state sales tax rate is 0 and the average NH sales tax after local surtaxes is 0. There is currently a 9 sales tax in NH on prepared meals in restaurants along with the same rate on short-term room rentals and car rentals. To request forms please email formsdranhgov or call the Forms Line at 603 230-5001.

Sales Tax On Grocery Items Taxjar

Deductions For Sales Tax Turbotax Tax Tips Videos

Monday Map Sales Tax Exemptions For Groceries Tax Foundation

Louisiana Sales Tax Rate Remains Highest In The U S Legislature Theadvocate Com

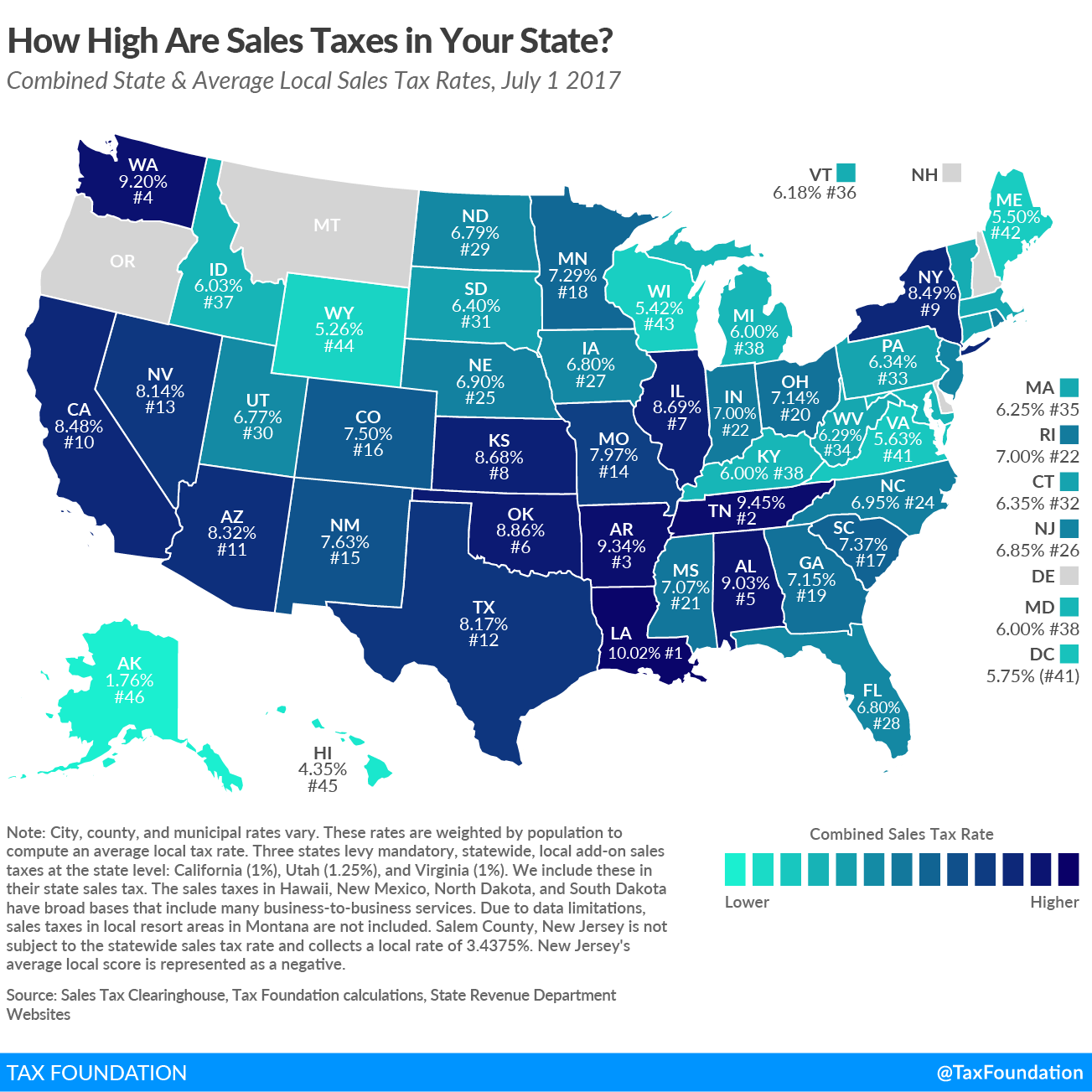

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

State Sales Tax Rates And Combined Average City And County Rates Download Table

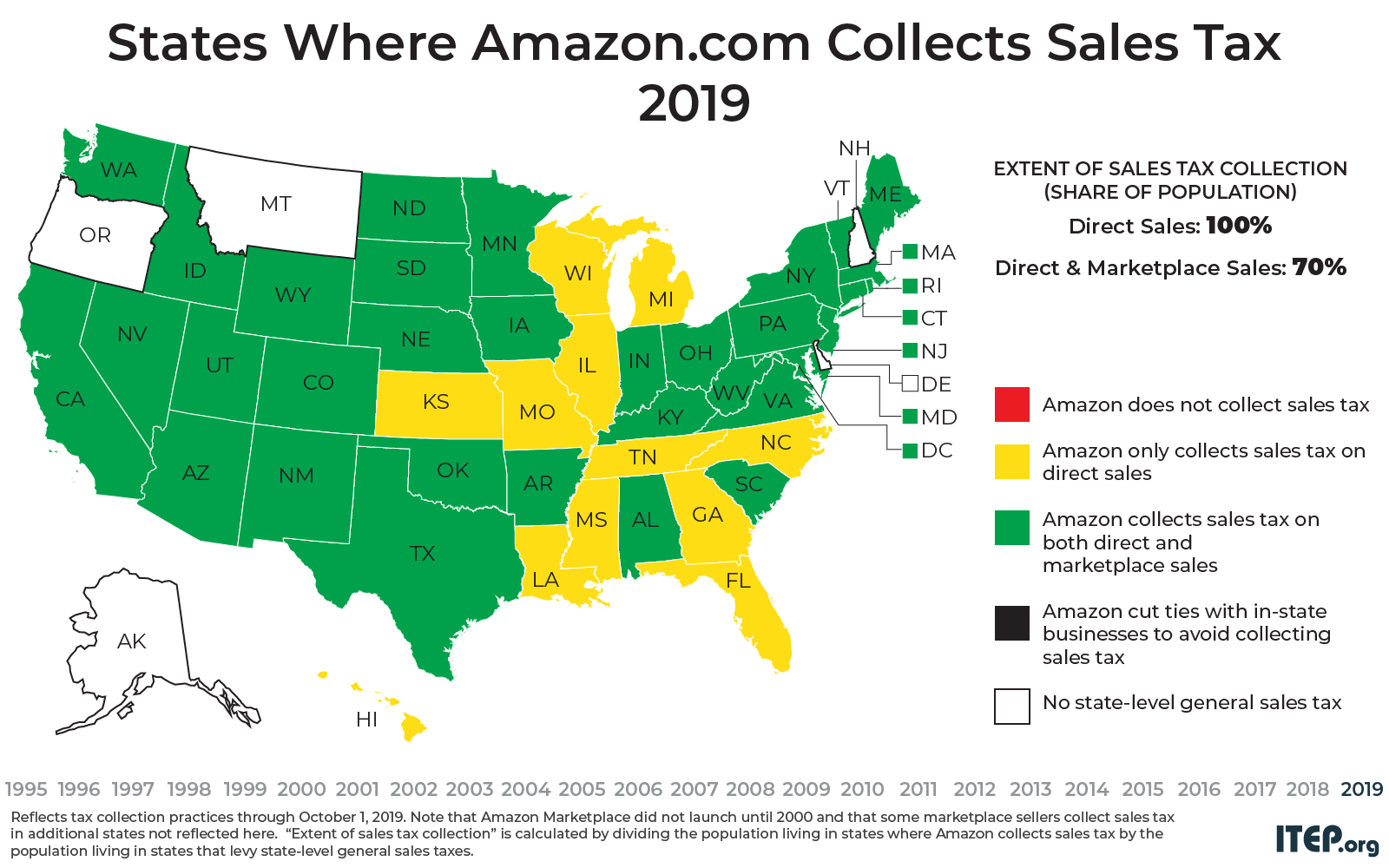

Amazon Tax Vs Existing State Use Taxes American History Timeline Accounting Services Tax

How Do State And Local Sales Taxes Work Tax Policy Center

How Do State And Local Sales Taxes Work Tax Policy Center

States Without Sales Tax Article

States With Highest And Lowest Sales Tax Rates

Sales Tax Exemptions Finance And Treasury

Sales Taxes In The United States Wikiwand

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

.png)